Warning: Your State is Among the 93 Hit Hardest by the Alarming Surge in ID Theft Reports Since 2019!

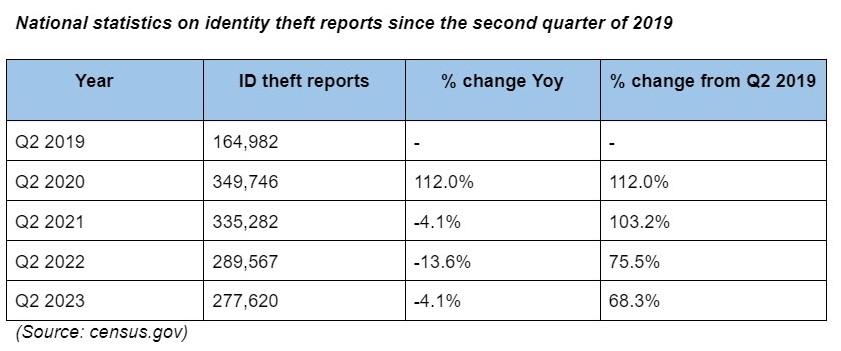

A pressing issue has emerged, one that revolves around the theft of identities – an alarming surge in identity theft incidents. Over the past few years, there has been a significant uptick in cases involving individuals illicitly obtaining personal and financial data to engage in fraudulent activities. To illustrate the gravity of the situation, it’s worth noting that reports of identity theft during the second quarter of the year have risen by almost 70.0% since 2019.

Frequently, those who fall prey to identity theft find themselves grappling with a burdensome and time-consuming situation, which not only has the potential to harm their credit score but also erode their overall sense of security.

Key Points

- Identity theft reports have surged by nearly 70.0% since 2019, based on a year-over-year comparison, with 277,620 reports submitted to the Federal Trade Commission (FTC) in the second quarter of 2023, marking a remarkable 68.3% increase compared to 2019 when 164,982 reports were filed.

- The COVID-19 pandemic played a pivotal role in the surge, with a significant influx of government relief funds leading to an astounding 3,000% increase in ID theft associated with government benefits in 2020, as reported on the federal Pandemic Oversight website.

- Credit card fraud remains the most frequently reported type of identity fraud, with 103,842 cases reported in the second quarter of 2023, reflecting a 61.3% increase since 2019.

- Government documents or benefits fraud saw a staggering 345.7% surge in reports from the second quarter of 2019 to the second quarter of 2023, with various subtypes, such as issued or forged driver’s licenses, applied for or received government benefits, and issued or forged government documents classified as other.

- In specific metropolitan areas, identity theft reports per 100,000 residents increased, with Hartford, Connecticut, Springfield, Massachusetts, and Worcester, Massachusetts, experiencing increases of 388.2%, 350.0%, and 345.8%, respectively, between the second quarters of 2019 and 2023.

- Conversely, only seven of the 100 largest metropolitan areas saw a decrease in identity theft reports, with Columbia, South Carolina, at the bottom of the list, registering a 34.1% decrease.

Related Post:

Losing Your Job Doesn’t Spell the End of Your Career

Why we tracked ID theft reports in the second quarter:

Our reliance on second-quarter data stemmed from the timing of our analysis. At the time of our study, the Federal Trade Commission’s (FTC) Consumer Sentinel Network, updated quarterly, had data available only up to the second quarter of 2023.

To present the most up-to-date statistics, we conducted a year-over-year comparison using second-quarter figures. In

perspective, the first quarter of 2023 saw 280,809 ID theft reports, similar to the 277,620 reports during the second quarter.

The Consumer Sentinel Network serves as a secure repository for consumer reports covering various aspects of consumer protection, including identity fraud incidents. It’s important to note that these reports are not authenticated but originate directly from consumers who contact the FTC through phone or online channels. Additionally, the database includes reports submitted to law enforcement agencies and entities like the Better Business Bureau (BBB).

ID Theft Reports are Up Nearly 70.0% Since 2019

The surge in ID theft reports from Q2 2019 to Q2 2023 is not just a minor uptick; it’s a massive leap. Our analysis uncovered a striking increase, with 277,620 ID theft reports submitted to the FTC in the most recent available data for the second quarter of 2023. This represents a remarkable 68.3% surge compared to the 164,982 reports filed in the same quarter of 2019.

What’s behind this significant increase? COVID-19, declared a global pandemic by the World Health Organization in March 2020, appears to be a pivotal catalyst. One crucial factor is the substantial influx of government relief funds distributed to the American populace, which provided fertile ground for opportunistic thieves. In 2020 alone, the FTC reported an astounding 3,000% surge in ID theft associated with government benefits, as reported on the federal Pandemic Oversight website.

The pandemic prompted a significant shift in consumer behavior towards online shopping. According to data from the U.S. Census Bureau, e-commerce sales saw a remarkable 43% uptick in 2020. With increased online transactions, criminals found more avenues to pilfer credit card numbers and other personal and financial information.

However, there is a silver lining to this situation. Although the general rise in ID theft reports from Q2 2019 to Q2 2023 has been substantial, there have been declines in the second quarter for the past three years. This trend is probably a result of the situation stabilizing after the initial surge in ID theft cases during the early stages of the pandemic.

Credit card fraud remains the most prevalent form; however, there has been a notable and significant increase in cases related to government documents and benefits fraud

Identity thieves employ diverse methods to target consumer identities. The FTC classifies reports of identity fraud into seven primary categories:

- Credit card fraud

- Other identity fraud

- Loan or lease fraud

- Bank fraud

- Employment or tax-related fraud

- Government documents or benefits fraud

- Phone or utility fraud

Credit card fraud consistently ranks at the top of the list as the most frequently reported type of identity fraud. Thieves have become increasingly sophisticated, no longer requiring physical access to your card to cause harm. They employ phishing, skimming, and other continually evolving schemes to target your credit card.

In Q2 2023, there were 103,842 reported cases of credit card fraud, encompassing both fraud on new and existing credit card accounts. This represents a significant 61.3% increase from Q2 2019, but it is worth noting a 7.8% decrease from Q2 2022. This trend reflects the impact of the COVID-19 pandemic, with reports surging in the initial year but gradually subsiding afterward.

Notably, government documents or benefits fraud is the category of identity fraud that witnessed the most substantial increase in reports between Q2 2019 and Q2 2023. Although it ranks as the second least common type of identity fraud overall, there was a staggering 345.7% surge in reports during this period. This category includes various subtypes, such as:

- Issued or forged driver’s licenses

- Applied for or received government benefits

- Issued or forged government documents classified as other

- Issued or forged passports

Close to 25% of the 100 largest metropolitan areas have witnessed a doubling of ID theft reports

Identity thieves appear more active in certain metropolitan areas than others. Among these regions, Hartford, Connecticut, Springfield, Massachusetts, and Worcester, Massachusetts, have experienced the most significant increases in ID theft reports per 100,000 residents, with their numbers more than quadrupling between the second quarters of 2019 and 2023. Specifically, they saw remarkable increases of 388.2%, 350.0%, and 345.8%, respectively.

Among the 100 largest U.S. metropolitan areas, 24 experienced a doubling or more in ID theft reports per 100,000 residents during that period. Conversely, only seven of these areas saw a decrease, with Columbia, South Carolina, at the bottom of the list, registering a 34.1% decrease in ID theft reports.

The metropolitan areas that observed decreases between Q2 2019 and Q2 2023 typically began with higher initial rates. For instance, Columbia, which saw the most significant decrease, had 123 reports per 100,000 residents in Q2 2019, making it the third-highest among the 100 metros analyzed. In contrast, Hartford, the area with the most substantial increase, had just 34 reports per 100,000 residents in the same quarter. None of the 24 metros where rates doubled between Q2 2019 and Q2 2023 had more than 42 reports per 100,000 residents in Q2 2019. Of the seven metros that experienced decreases, all had 46 reports or more in Q2 2019. Thus, 2019 set the trend for how things played out in 2023 in many cases.

It’s also noteworthy that the metropolitan areas with the most substantial increases in ID theft reports between Q2 2019 and Q2 2023 were often those where a significant portion of the recent quarter’s totals consisted of government documents or benefits fraud. For instance, more than half of Hartford’s Q2 2023 ID theft cases were related to government documents/benefits fraud, accounting for 1,201 of the total 2,015 cases.

Further Q2 2023 examples include:

- Springfield, Mass.: 314 of 690 were for government documents or benefits fraud

- Worcester, Mass.: 449 of 1,044 were

That compares with those with the largest decreases in ID theft reports:

- Columbia, S.C.: 24 of 667 were for government documents or benefits fraud

- Greensboro, N.C.: 11 of 403 were

- Pittsburgh: 63 of 1,319 were

As per an analysis conducted by the Associated Press (AP), it is suggested that over $280 billion in COVID-19 relief funding might have fallen into the hands of fraudsters. It’s important to note that this amount will likely increase as more evidence surfaces over time.

In Baton Rouge, Louisiana, where there was a significant 72.2% decrease between Q2 2022 and Q2 2023, the most prominent issue was credit card fraud. Of 724 reports, 311 were related to credit card fraud, while only 16 reported government documents or benefits fraud. This marked the highest decline among the 100 largest metropolitan areas.

Supplementary information: Incidents of identity theft reported per 100,000 residents during the second quarter of 2023, categorized by urban areas

Since 2019, there has been an increase in identity theft reports in every state across the country

Not a single state has escaped an increase in ID theft reports since 2019, and the rise has been significant, with every state experiencing a surge of more than 11.0% in ID theft reports per 100,000 residents over this period.

At the forefront of this trend is Massachusetts, where there was an astonishing 306.1% increase in ID theft reports per 100,000 residents between Q2 2019 and Q2 2023. Massachusetts is closely followed by Connecticut, which saw a 270.6% increase, and Colorado with a 169.0% rise. These states are part of the 16 states where reports more than doubled during this timeframe.

Massachusetts’ metropolitan areas accounted for the second, third, and fourth most significant increases between Q2 2019 and Q2 2023, propelling the state to the top. Similarly, Connecticut had three metropolitan areas in the top 10, with the first, fifth, and eighth most substantial increases, while Colorado had one metropolitan area ranking as the seventh biggest.

Supplementary information: Variations in ID theft reports per 100,000 residents between the second quarters of 2022 and 2023, categorized by state

Supplementary data: Incidents of identity theft reports per 100,000 residents during the second quarter of 2023, organized by state

Cafecredit Methodology

This study focuses on the sharp increase in identity theft reports since 2019. We collected data primarily from the Federal Trade Commission’s (FTC) Consumer Sentinel Network, which compiles consumer-submitted identity theft reports.

We analyzed data up to the second quarter of 2023, comparing it to previous years to identify trends. Reports were categorized into types, such as credit card fraud and government documents or benefits fraud.

Our analysis revealed significant increases in identity theft reports. We explored potential factors behind this surge, including the impact of the COVID-19 pandemic and government relief fund distribution.

At the metropolitan and state levels, we ranked areas with notable increases and decreases in identity theft reports per 100,000 residents.

Our findings were interpreted to highlight key trends, and we discussed their implications, including the need for increased awareness and protection against identity theft.

Please note that the data used is consumer-submitted and not authenticated, and our study’s scope was limited to data available up to the second quarter of 2023 due to update schedules.